Rising gas prices, inflation, and overall higher costs are very real these days and could indicate an upcoming recession according to economic experts. Whether we’re heading into a recession or not, there are multiple things you can already do today to be prepared for one. In this article, we’ll not only give you a better understanding of what a recession, is but we will also show you how to make your own business recession protection plan.

What Is a Recession?

Before you start making your business recession plan ready, you should first understand what a recession is and how it impacts your cash flow. According to the National Bureau of Economic Research (NBER) a recession is a: “significant decline in economic activity that is spread across the economy and that lasts more than a few months,” which is typically visible in numbers such as the GDP, unemployment rate, or wholesale-retail sales. Although the NBER is not speaking about a specific period of time, when a recession is talked about you may often hear about a decline that lasts for more than two quarters. The NBER is the organization that officially announces recessions, so keep yourself up to date with their announcements.

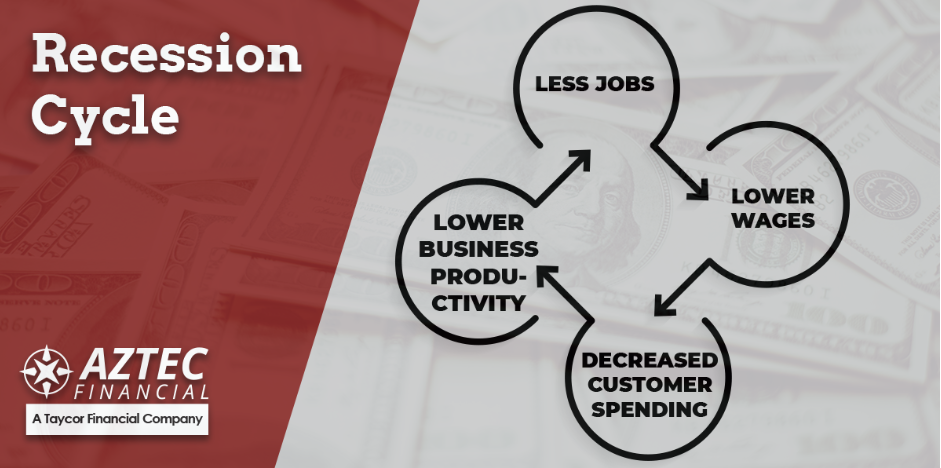

The truth is that cash flow reduces in a recession, which means that small businesses usually get affected more than medium to large businesses. Small businesses rely on their customers to pay on time, so they falter quickly when this is no longer guaranteed. Since the recession also affects paying customers, they may have difficulties paying on time, and a chain reaction begins. The problem with recession is that it easily becomes a vicious cycle: Cash flow and liquidity get tightened which causes businesses to fire employees, which then results in weakened purchasing power. The good news is that there are measures businesses can take ahead of a recession, and some industries are more recession-resistant than others.

Is Your Business Recession Resistant?

Some industries are independent of economic crises as they cover basic human needs. The first things that may come to your mind are grocery stores and healthcare, since people need these services to survive. There are other industries you may not have been thinking of, though:

- Grocery and food

- Healthcare

- Telecommunications

- Education

- Commercial cleaning

- Disaster restoration

When wondering if your business is recession-resistant, ask yourself:

- Would you pay for the offered product or service when you have less money to spend?

- In which areas would you cut back last?

While there is no 100% recession-proof business, some products and services are always in demand. Regardless, businesses facing a recession will need to prepare for a tightened cash flow.

How You Can Prepare for A Recession in Case One Happens

- Make funds available: Diversify your borrowing options so that your cash remains available for emergencies. This includes using different types of financing for different purposes. Get financing for your equipment, use working capital solutions such as business lines of credit and look for options to finance your fleet. Not sure how to do this? Our finance specialists are available to help you determine which borrowing options are available for your business.

- Understand your cash flow: By knowing and understanding your numbers, e.g., what comes in and what goes out, you’ll be able to make adjustments where it’s necessary. You can quickly determine what you really need and what you don’t. That will not only help your business in case of a recession but is also necessary to build a long-term, successful business.

- Get in front of new customers: Don’t stop advertising. There are many ways to get your business out there without spending a fortune. Sharing on social media is a simple and inexpensive way to gain more customers. Having good reviews on Google, Yelp, and other review sites is another. Have a work vehicle? Add a wrap for a long-lasting, moving billboard that tells people what you do and how to contact you. Unfortunately, often businesses shorten marketing activities in order to save money when cash flow gets low. You can prepare in advance for a recession by purchasing long-lasting advertising means and by continually improving your online presence.

- Strengthen your relationships: Not only should you look out for new customers, but also maintain the relationships you already have. Doing so increases the chance that they become repeat customers. They are also more likely to recommend your business to others such as their family and friends, which is a great way of getting free advertising.

- Make your business adjustable: The recent pandemic showed us that in order to get through hard times a business must be able to pivot. That doesn’t mean that you need to overthink your product or service. Rather what is meant is that you need to be close to your customers, remain in contact with them, and find out what they need and how their needs may have changed. Consider where you can adjust your business to meet your customer’s needs – especially if money becomes tight.

- Start now! Finally, the most important thing to do is start today. Preparing for a recession can take some effort, and it is better to prepare as soon as possible.

This post originally appeared on Aztec Finacial's blog.

Enjoyed reading this post? Read the following articles: